IRS Report of Foreign Bank and Financial Accounts (FBAR)

Wednesday, July 27th, 2016 @ 6:09PM

CFEG reports that it recently obtained the information below pursuant an order entered by the U.S. District Court for the District of Columbia where the IRS is producing documents on a monthly basis in response to Freedom of Information Act (FOIA) requests. The information may be helpful to taxpayers who may be required to file an FBAR form with the IRS.

Report of Foreign Bank and Financial Accounts (FBAR)

If you have a financial interest in or signature authority over a foreign financial account, including a bank account, brokerage account, mutual fund, trust, or other type of foreign financial account, exceeding certain thresholds, the Bank Secrecy Act may require you to report the account yearly to the Department of Treasury by electronically filing a Financial Crimes Enforcement Network (FinCEN) 114, Report of Foreign Bank and Financial Accounts (FBAR). See the ‘Who Must File an FBAR’ section below for additional criteria.

Current FBAR Guidance

FinCEN introduces new forms

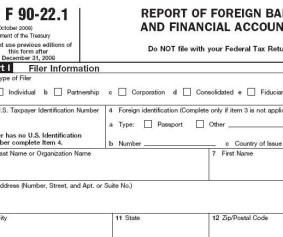

On September 30, 2013, FinCEN posted a notice on their website announcing the current FBAR form, FinCEN Report 114, Report of Foreign Bank and Financial Accounts. FinCEN Report 114 supersedes the previous years’ form TD F 90-22.1 and is only available online through the BSA E-Filing System website. The e-filing system allows the filer to enter the calendar year reported, including past years, on the online FinCEN Report 114. It also offers filers an option to “explain a late filing” or to select “Other” and enter up to 750-characters within a text box to provide a further explanation of the late filing or to indicate whether the filing is made in conjunction with an IRS compliance program.

Posted by cfegov

Categories: IRS FOIA Documents